―

U.S. interest rate hikes

―

“Keep at it.”ᅳThese are the words of Jerome Powell, Chairman of the Federal Reserve, central bank of the United States, at a press conference in late August.

What will they continue doing? He is referring to the rate hikes in the U.S.

https://www.ft.com/content/f2a6d9ac-24de-4e10-8fd6-924e8a45b047

(Go to related articles)

The US Federal Reserve, having overcome the corona pandemic with historic interest rate cuts and money loosening, is now tightening money by raising interest rates to keep up with rising inflation. And now once more it is taking action equally rapidly.

The US benchmark interest rate, which was 0.25% at the beginning of this year, has jumped to 3.25% as of September and is expected to rise to 4.25% or even 4.50% by year's end. In September, Chairman Powell said, “We have to keep up with inflation. I wish there were a painless way to do that. There isn't.”

―

Only the dollar is rising

―

Interest rates represent the value of money.

When the US, the reserve currency, raises interest rates, the value of the dollar increases. Investors around the world convert their money invested in other countries into dollars and move them into dollar-denominated assets. The “king dollar” phenomenon devalues currencies other than the dollar. When the value of money falls, inflation rises and the burden of dollar-denominated foreign debt increases, which can lead to a foreign exchange crisis.

In response to this, central banks around the world also seem to be in a hurry to raise interest rates. Accordingly more than 60 countries around the world have raised their benchmark interest rates.

In September alone, the Swiss central bank increased 0.75 percentage points, the Norwegian central bank 0.50 percentage points and Taiwan's central bank 0.125 percentage points. The Central Bank of England also increased by 0.50 percentage points and the central banks of Sweden and Canada by 1 percentage point.

(Interest rates change in developing countries: the number of countries that raised interest rates increased from 5 to 51. Source: UNCD)

Emerging economies with relatively weak economies are more severely affected. Ghana raised its benchmark interest rate to 22% last month and Argentina to 75%. Zimbabwe in Africa has the highest interest rate in the world at 200%.

―

World Bank warns about rate hikes

―

Recently, international organizations are raising concern about interest rate hikes in each nation. First, in September, the World Bank warned that global monetary tightening could lead to a “disruptive recession” of the global economy in the coming year.

The World Bank said that simultaneous interest rate hikes by central banks around the world could lead to a global recession in 2023, fearing that emerging markets and developing countries could go into a financial crisis. It also analyzed that the world economy is currently in the steepest recession since it recovered from the recession that followed the 1970 crunch.

Unless the current supply disruption and job market burden are resolved, core inflation excluding energy is expected to remain at about 5% through next year. This is more than double the five-year average before the coronavirus pandemic.

―

UN warns that Fed rate hike hurts developing countries

―

The United Nations has also voiced criticism of the policy of raising interest rates. On October 3rd, the U.N. Conference on Trade and Development (UNCTAD) strongly criticized the U.S. and other advanced countries' interest rate hikes in the '2022 Trade Development Report,' warning that they can harm developing countries.

Such rate hikes are at risk of doing more damage than during the 2008 financial crisis and the 2020 coronavirus pandemic. According to the report, if the US Federal Reserve raises the benchmark interest rate by 1 percentage point, economic output in other developed nations will shrink by 0.5% and economic output in poor countries will decrease by 0.8% over the next three years.

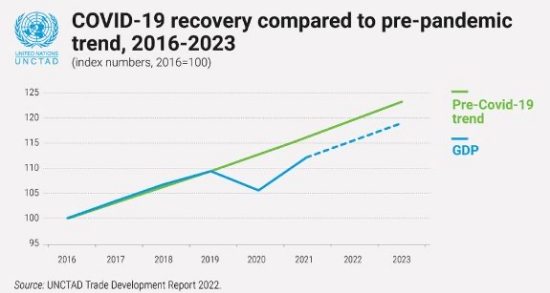

The global economic growth rate, which is expected to grow by 2.5% in 2022, is expected to slow to 2.2% next year, and real GDP is expected to be US$17 trillion lower than the pre-pandemic trend.

The global slowdown will affect all countries, but the developing world most exposed to debt, health, and climate crises will be hit hardest. Among them, middle-class countries in Latin America and low-income countries in Africa are expected to record the sharpest economic slowdowns this year.

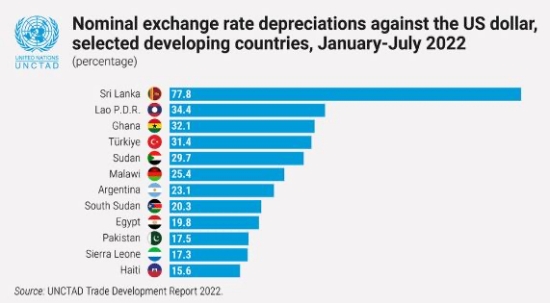

In addition, as the global financial situation worsened from the fourth quarter of last year, funds from developing countries have continued to flow out. About 90 developing countries have devalued their currencies against the dollar this year. It is estimated that the difference amounts to more than 10% against the dollar.

Sri Lanka's currency, which already suffered national bankruptcy and was bailed out by the IMF (International Monetary Fund), dropped 77.8% against the dollar this year. Now, 46 developing nations have experienced severe economic shock, and 48 are undergoing significant setbacks, the report said.

(Status of developing countries with lower nominal exchange rate against the dollar, January-July this year)

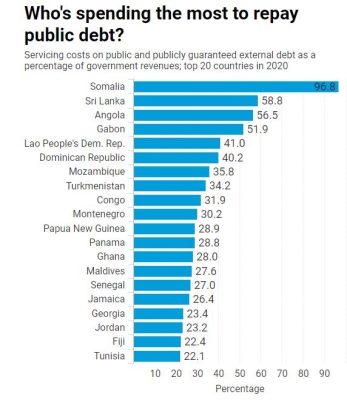

Developing countries have already spent about US$379 billion this year to prop up their exchange rates—almost double the number of special drawing rights (SDRs) newly allocated by the IMF to developing nations.

* Special Drawing Rights (SDR): The right to withdraw foreign currency without collateral when an IMF member needs dollars.

(Ranking of the 20 countries spending the most to pay off their public debt)

The problem is that, despite these efforts by developing countries, concerns are expressed in the report that many countries' foreign exchange crises are growing. The report pointed to a surge in energy prices and an increase in import costs due to exchange rate fluctuations as the cause of inflation in many developing countries.

Thus, rather than raising interest rates, it urges more direct price regulation, such as introducing a one-time windfall tax on energy companies that made a lot of money, anti-monopoly regulation, and strict regulation on speculation.

Recently, the US Federal Reserve has also raised concerns about emerging market risks due to interest rate hikes. In September, Fed Vice Chair Lael Brainard cautioned, "Monetary policy tightening to combat high inflation around the world spreads risks internationally and is more likely to create baleful synergies with financial market fragility."

https://www.ft.com/content/cb3816bb-bb62-4828-a575-aab3c54bed87

(Link to article)

It is no surprise that the US central bank sets policies for the US economy. However, the US dollar is already the world's reserve currency. When the global economic crisis comes, is there any commodity that has a greater impact than the dollar?

“There is still time to step back from the brink of a recession,” said Rebeca Grynspan, UNCTAD Secretary General. "We have the tools to calm inflation and support all the vulnerable, and it's a matter of policy choice and will."

https://unctad.org/osgstatement/launch-trade-and-development-report-2022

So what remains to be seen is how long the Fed's 'Keep at it' will last.

Written by Sharon Choi

Director of Planning

Sunhak Peace Prize Secretariat